|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance House After 6 Months: Key Considerations and StepsRefinancing your home can be a smart financial move, especially if you've experienced changes in interest rates or your personal financial situation. However, considering a refinance just six months after your initial purchase requires careful consideration. This article explores the important factors and steps involved in refinancing your home after such a short period. Understanding Early RefinancingRefinancing your house within six months of purchase may seem unusual, but there are valid reasons to consider this option. Whether it's to take advantage of lower interest rates or to change loan terms, it's essential to understand the potential benefits and drawbacks. Reasons to Refinance Early

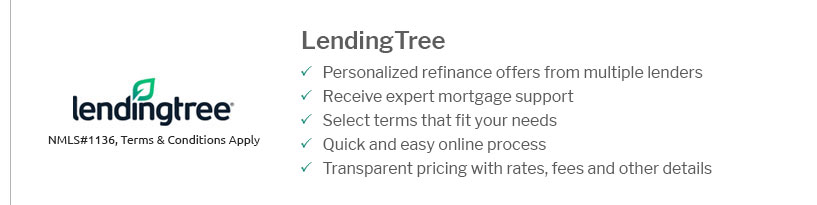

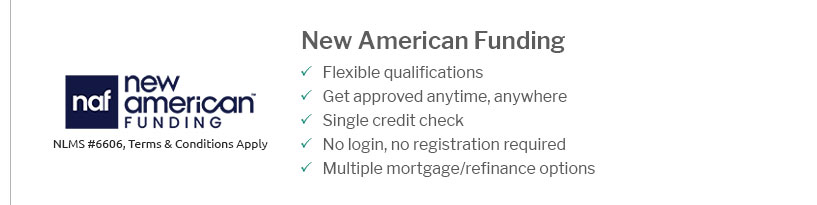

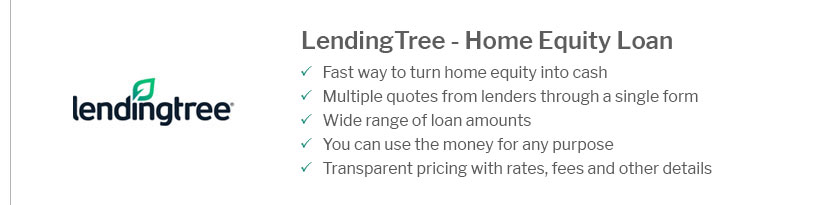

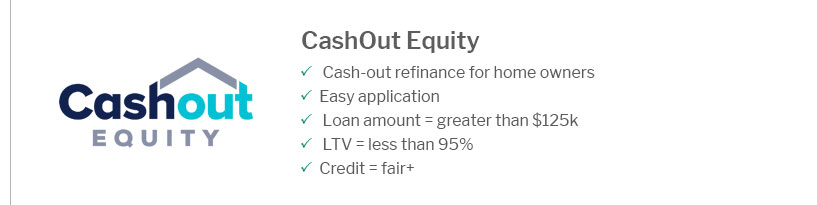

Steps to Refinance After 6 MonthsThe process of refinancing your home involves several steps, and doing so shortly after your initial purchase necessitates careful planning. Evaluate Financial BenefitsBefore proceeding, calculate potential savings to ensure refinancing makes financial sense. Consider both short-term and long-term impacts on your financial health. Consult with LendersIt's advisable to discuss your options with various lenders to find the best terms. This can help you understand the potential cash back from refinance possibilities and other benefits. Potential Challenges and ConsiderationsRefinancing early comes with its own set of challenges and considerations that must be weighed carefully. Prepayment PenaltiesSome loans may include prepayment penalties for paying off the loan early. It's crucial to review your current loan terms to avoid unexpected costs. Closing CostsRefinancing involves closing costs, which can add up. Ensure that the potential savings outweigh these expenses over time. FAQ

https://www.reddit.com/r/RealEstate/comments/uxqwdu/if_i_buy_a_home_today_would_i_be_able_to/

Yes you can refinance if the rates go down, but it's not necessarily quick, cheap, or easy. In comparison to buying a house it is, but either the rate ... https://movement.com/2020/05/how-soon-after-purchasing-my-home-can-i-refinance

A cash-out refinance, in which you are borrowing extra funds against your home equity, typically has a six month waiting period (and you probably don't have ... https://homesteadfinancial.com/refinance/how-soon-after-purchasing-can-i-refinance/

That's because, before 6-months, the lender may lose their original commission. On the other hand, if you want a cash-out to refinance, you'll ...

|

|---|